Investors lose money all the time. It is not the first time and it won't ever be the last. Often, retail investors who couldn't afford to lose their hard-earned money fall victims to their own greed and are also done in by their utter lack of due diligence/incompetency in the investments they put their money in.

Many lost money through unregulated investment schemes and frauds hatched to swindle money. But, what about the "supposedly regulated" stocks or securities listed on the SGX, the bond market supposedly governed by regulations in Singapore? This certainly raises eyebrows.

|

| Curious case of a retiree parading outside a local bank. Just what did he invest in? Sounds like very poor due diligence. |

As a frequent reader of 30 Year Old Investor, you would know by now that K.C. always advocates against putting our money with unregulated "alternative investments". As shared in a previous blog post, I suggested that we avoid MLMs or such investment schemes at all cost because they usually show these red flags:

- High guaranteed returns (Too good to be true)

- Short time frames of investment

- Limited time offer (artificial scarcity)

- Introduce more friends to get kickbacks

- Not regulated by MAS/on alert list

Case in point: Sunshine Empire

https://www.straitstimes.com/singapore/courts-crime/guilty-as-charged-sunshine-empire-duped-investors-james-phang-wah-2006

Sunshine Empire was an elaborate Ponzi Scheme set up in 2006 that cheated investors a total of almost $190 million. Only $21 million was recovered.

Victims of the scam told local newspapers at the time that they had been "naive" and "stupid".

"I was naive and foolish," one undergraduate told The New Paper. She had put in $66,000 into the scheme, using money borrowed from her parents. "I really thought it was easy money."

Case in point: Macro Realty Developments

https://www.straitstimes.com/singapore/courts-crime/sporeans-victims-in-australian-ponzi-scam

This Australian based Ponzi scheme that raised approximately A$100 million (S$107 million) had 981 investors from Singapore, 651 from Malaysia, 58 from Britain, 17 from continental Europe and 31 from Australia. (2014- 2016)

Said a female corporate executive who had invested in the scheme for long-term gain: "I am distressed and devastated, and trusted too much in the system."

Case in point: Profitable Plots

https://www.asiaone.com/singapore/profitable-plots-case-directors-jailed-3million-scam

Investors lost around $3.1 million in the Boron bonds scheme between November 2008 and August 2010. The two directors of land banking firm Profitable Plots promised 12.5 per cent in returns within six months.

Case in point: Ecohouse Group

https://www.straitstimes.com/singapore/housing/too-good-to-be-true-property-deals-that-turned-sour

London-based EcoHouse enticed many investors with its unique proposition of investing in social housing in Brazil. Investors were asked to shell out at least £23,000 ($47,150) in exchange for an impressive 20 per cent fixed rate of return for a 12-month contract. The scheme reportedly attracted over 2,000 investors globally, while at least 800 people in Singapore were said to have ploughed about $65 million into the scheme since 2011.

But, what about the "supposedly regulated" stocks or securities listed on the SGX, the bond market supposedly governed by regulations in Singapore?

Are you seeing a pattern here? It is always amazing how such plots and schemes repeatedly lure unsuspecting investors. However, if we think investing in regulated securities means we are much safer, we couldn't be more wrong. A combination of changing markets can just as easily sink companies that are not so prudent.

Most recent case in point: Hyflux

Lauded as the success story of Singapore, Olivia Lum founded Hyflux in 1989 with only a mere $20,000 and Hyflux has grown to become a leading player in water treatment responsible for 30% of Singapore's daily water needs. It was a much celebrated story.

https://www.channelnewsasia.com/news/business/a-big-shock-retail-investors-in-singapore-caught-out-by-hyflux-10407930

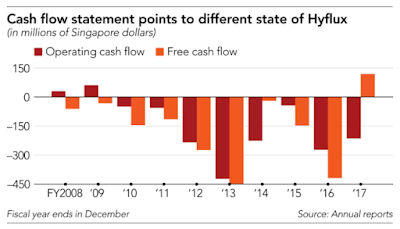

Years of risky and aggressive expansion has seen Hyflux take on more debts than it can handle. In fact, Hyflux has seen certain red flags over the years largely on its dipping profit margins, ROE and negative cashflows since early 2010.

Mismanagement of debts?

Notwithstanding the struggle to turn profits, Hyflux's management also did a series of baffling decisions over the years. This included continuing to give out dividends especially including a relatively higher dividend yield of 4.82% in 2018 despite its financial situation. If it was mired in debt and had little cash flow from which to dish out dividends from, where do the dividends come from?

On 11 Feb 2019, Investor watchdog asked Hyflux to explain why huge dividends and executive salaries, benefits and bonuses were still paid. All this despite Hyflux being in debt and not being profitable.

The Curious case of PERPS

Then, comes the curious case of Perpetual securities. In a commentary article, PERPS risks were highlighted as many companies started to issue PERPS and the total capital raised from a range of firms amount to $3.96 billion in 2017. But they still proved to be a viable option to raise capital for companies because there seemed to be a growing appetite for PERPS among retail investors even they though may not be nimble enough to pick out the potential risks.

PERPS function as bond-like instruments that allow a company to defer interest payment in specific situations without the worry of getting sued for bankruptcy. There is no maturity and issuer can redeem at their discretion and timeframe. It also allows them to raise capital without dilution of shares as they can count as equity not debt. (this is a huge potential issue if investors are not careful)

This sparks a question whether a company mired in debt should be allowed to raise funds through PERPS as investors may not be able to recognise they are taking on huge risks for companies in financial trouble. But what exactly are these PERPS?

MoneySense website has a rather short and concise summary about what PERPS are:

All isn't well now for Hyflux investors due to the fact that CEO Olivia Lum promised to ensure fair treatment to shareholders but retail investors are likely to bear the brunt of the losses now. A combination of equity dilution for equity holders and high losses for bonds (almost close to a default) doesn't bode well for retail investors. I can't help but think that regulators could have done much more to protect the interests of investors who are at risk (older folks who cannot afford to lose their capital).

Case in point: Noble

Noble Group was another company that saw many investors losing their money. It was once Asia's largest commodity trader but have found itself deep in debt, having to default on US$3.4 billion of debt. Investors similarly saw share dilution and default on bonds as its value plunged since 2015. Institutional investors and buyers of bonds have made losses but again the likely biggest losers are retail investors. Similarly, Noble also issued perpetual bonds as well. (Which added to more debts. Are we seeing a pattern here?)

After its steep losses, allegations that it has deceived its investors through its accounting have emerged to which they have denied.

Poor financial accounting or irregularities?

Noble Group found itself under scrutiny for allegedly providing financial accounting figures to mislead investors about its financial performance. This allowed Noble to supposedly record profits on long-term deals to source and supply commodities even before the company receives cash payments.

Again, we see a company raking up huge amount of debts with dropping revenues and profit margins.

|

| Prime Minister Lee Hsien Loong at Hyflux's Tuaspring official opening. Source: ©Hyflux Website |

There was a huge endorsement by the government. Even the Prime minister gave his stamp of approval over the years and was there for the opening ceremony for the Tuaspring plant back in 2013. What can go wrong, when such a "successful" company issue preferential shares and perpetual securities offering high yields? Of course they were well sought after, to great devastation for some of the retail investors many of whom were retirees.

https://www.channelnewsasia.com/news/business/a-big-shock-retail-investors-in-singapore-caught-out-by-hyflux-10407930

Seen as one of Singapore’s most successful business stories, water treatment specialist Hyflux’s recent woes had come as a shock for many and for Mrs Goh, it was something that she had not seen coming.

Lured by an attractive 6 per cent coupon, she had put in S$10,000 into the company’s preference shares issued in 2011 at S$100 apiece.

Both tranches saw strong demand when they were issued, attracting yield-hunting retail investors who subscribed through ATMs. Mr Nallakaruppan said he knew of investors who had put in S$200,000 or more, with retirees among them.

“Interests rates at the banks were just far too low and because of that, a lot of the investors were hunting for yields,” he said. “They also see Hyflux as a growth company dealing with an important resource.”

|

| Hyflux's profit/revenue and ROE from 2008. |

|

| Hyflux's Cashflow from 2008. |

|

| Hyflux's growing debts over the years. |

Mismanagement of debts?

Notwithstanding the struggle to turn profits, Hyflux's management also did a series of baffling decisions over the years. This included continuing to give out dividends especially including a relatively higher dividend yield of 4.82% in 2018 despite its financial situation. If it was mired in debt and had little cash flow from which to dish out dividends from, where do the dividends come from?

|

| Hyflux's Dividends declared from 2010 (StocksCafe) |

Apart from the more than S$60 million in dividends, Mr Gerald noted that Ms Lum also received “significant salary, benefits and bonuses” and earned between S$750,000 and US$1 million in 2017. In Hyflux’s annual report, key executives were said to have had received a total remuneration of S$2,695,134.20 for that financial year.

“(This was) a year which Hyflux reported losses of S$115.6 million and a period which was five months prior to Hyflux Group filing for court protection from creditors and when Hyflux has been losing huge amounts of cash and building projects,” noted Mr Gerald.

The Curious case of PERPS

Then, comes the curious case of Perpetual securities. In a commentary article, PERPS risks were highlighted as many companies started to issue PERPS and the total capital raised from a range of firms amount to $3.96 billion in 2017. But they still proved to be a viable option to raise capital for companies because there seemed to be a growing appetite for PERPS among retail investors even they though may not be nimble enough to pick out the potential risks.

PERPS function as bond-like instruments that allow a company to defer interest payment in specific situations without the worry of getting sued for bankruptcy. There is no maturity and issuer can redeem at their discretion and timeframe. It also allows them to raise capital without dilution of shares as they can count as equity not debt. (this is a huge potential issue if investors are not careful)

This sparks a question whether a company mired in debt should be allowed to raise funds through PERPS as investors may not be able to recognise they are taking on huge risks for companies in financial trouble. But what exactly are these PERPS?

MoneySense website has a rather short and concise summary about what PERPS are:

- Perpetual securities are often referred to as "perps", or perpetual bonds and perpetual notes.

- Perpetual securities have no maturity date, but an issuer may choose to redeem the after a specified period of time.

- You could end up holding the perpetual securities forever, without any reward.

Basically, one may still lose some or all of their money. The very same High Yields that attracts investors may turn out to be a double-edged sword as it also represents higher risks. It solely rests upon the issuer to make good of their promise to compensate investors while investors take on the risk of the company.

Kyith at InvestmentMoats blogged about Perpetual Securities – What you need to know as Stock Investors and considers PERPS to be a neutral tool for companies to raise funds. However, some companies might abuse the PERPS hybrid status as Rating agency Moody considers 50% of perpetual issues as equity. More astute investors would wisely categorise them rightfully as debt.

Investors should also consider why companies are raising funds and for what purpose/use do the funds go to.

Kyith at InvestmentMoats blogged about Perpetual Securities – What you need to know as Stock Investors and considers PERPS to be a neutral tool for companies to raise funds. However, some companies might abuse the PERPS hybrid status as Rating agency Moody considers 50% of perpetual issues as equity. More astute investors would wisely categorise them rightfully as debt.

Investors should also consider why companies are raising funds and for what purpose/use do the funds go to.

|

| PERPS infographic. ©MoneySense |

This means that for every $1,000 invested, a holder of Hyflux’s perpetual securities and preference shares will recover just $106.54, or an implied return rate of 10.7 per cent - from $30.15 in cash and $76.39 of implied value in Hyflux shares.

For medium-term noteholders, who are of a higher priority on the creditors’ list, the implied return rate is 24.6 per cent, or $246.35 for every $1,000 invested. This is from a cash payout of $138.72 and $107.63 in Hyflux shares.

Noble Group was another company that saw many investors losing their money. It was once Asia's largest commodity trader but have found itself deep in debt, having to default on US$3.4 billion of debt. Investors similarly saw share dilution and default on bonds as its value plunged since 2015. Institutional investors and buyers of bonds have made losses but again the likely biggest losers are retail investors. Similarly, Noble also issued perpetual bonds as well. (Which added to more debts. Are we seeing a pattern here?)

Francis Tay feels cheated.

The former Singapore civil servant said he lost almost S$50,000 ($36,600) in the implosion of Noble Group Ltd., the commodity trading giant. He also said shareholders like him have been let down by regulators whose job it is to protect them from the sort of crisis that’s brought the company to the brink.

"I was cheated of my hard-earned savings," said Mr Tay, who still owns a small amount of shares. "How can a giant company collapse?" he said in an interview earlier this month in the run-up to the shareholder vote, adding: "What message does that send to the world about Singapore's reputation?"

Lisa Ng, an administrative manager in the finance sector, said she lost about 90 percent of her investment in Noble, or at least S$5,000. She said she wouldn’t attend the SGM because she considers her shares a write-off. Selling them would cost her more in fees than what she’d now recover, she said.

“I do wish that I had gotten out when Iceberg had come out with its critique of Noble’s accounting,” the 61-year-old said. “I thought that Noble, being a blue-chip share, wouldn’t be like what they claimed.”

|

| Noble Group over the years. |

Poor financial accounting or irregularities?

Noble Group found itself under scrutiny for allegedly providing financial accounting figures to mislead investors about its financial performance. This allowed Noble to supposedly record profits on long-term deals to source and supply commodities even before the company receives cash payments.

Again, we see a company raking up huge amount of debts with dropping revenues and profit margins.

|

| Net income and gross profit from 2014 (In millions SGD, from SGX website) |

|

| Noble's Debts over the years since 1994 |

I still remember when I first started investing, Noble Group was one of those stocks that some "Guru" recommended a screaming BUY online back in 2017 given its glorious history despite its red flags. The argument was that the Oil and gas sector was due a rebound from a bottom and a rising tide would lift all boats (that never really materialized). Meanwhile, Noble continued to bleed.

To resolve Noble's outstanding debts, a "do-or-die" deal was forced upon investors who had not much other options than to bend over that would see a proposed debt for equity deal being cut. This meant a dilution of shares while Noble's debt is cut.

Existing shareholders equity would be reduced to 20 per cent of the restructured business.

On 6 December 2018, Singapore authorities said they would block the re-listing of shares in what was once Asia’s top commodity trader. Recently in February 2019, Noble Group Limited announced it was in liquidation process.

Application for winding-up of Noble Group Limited to be heard on 8 February 2019, liquidation process is a procedural step and as anticipated in the circular to shareholders dated 10 August 2018. The liquidation process will have no impact on the business or financial position of Noble Group Holdings Limited. The winding-up application and liquidation process will have no impact on the rights of shareholders of Old Noble to receive shares in New Noble.

Noble Group shares are currently suspended since November 2018.

Case in point: Swiber

Swiber Holdings, an oilfield services firm rocked the investing community in 2016 when it suddenly announced its application to wind up the company as debts mounted. Swiber shares started declining in 2014 and again potential red flags were beginning to appear in 2015.

Swiber's liabilities stood at US$1.43 billion as of March 31 2016 while its total assets amounted to US$1.99 billion. Coupled with a low free cashflow and slump in the industry, it could no longer turn profits to cope with the high amount of debts.

Similarly, Swiber also issued perpetual securities. It had proceeded to redeem S$130 million of notes on June 6 and S$75 million of debentures on July 6, according to company filings, and made an early repayment of its perpetual bonds, a hybrid security with no preset maturity, in September 2015.

Once again, it seemed that companies who borrow excessively land themselves in debts they could not repay as they are not prudent.

The sudden fall from grace of the firm, which supports construction projects on oil rig platforms, shocked the market yesterday. But for Maybank Kim Eng analyst Yeak Chee Keong, it did not come as a complete surprise.

"Its high gearing and poor profitability have been a red flag for quite some time," he said.

The warning lights have been flashing for some time, particularly as the global offshore and marine industry continues to be hit hard by a protracted slump in oil prices.

What can we do to prevent ourselves falling victims?

1. Do Due Diligence (DYODD)

Never buy securities based on banks' recommendations alone and never buy what you do not understand (think perpetual securities). Never ask the barber if we need a haircut. If we go to banks and they recommend certain securities, we ought to be careful to research if the securities' risk to reward is worth it. We might just get more than what we bargain for if it goes south.

Never under-estimate companies with poor financials, they are simply not worth the heartpain. Take note of potential warning signs (Poor management, increasing debts/falling profit margins/lack of free cashflow). Base your investments on facts and not emotions. Don't just assume it is safe if big funds/many retailers are also investing in what you are going to invest in. This might be a false sense of security.

2. Diversify/Size our holdings:

By diversifying our holdings across different sectors, we are minimising over exposure to any one sector. It could dilute our earnings but it could also mean our portfolios can float better if certain investments go south. If we cannot find sufficient relevant information to build a case for investment about certain stocks, we should size and position accordingly if we still decide to invest so that it remains a small proportion of our portfolio as it is likely to be more risky.

Set up a trading/investment plan with strict stop losses and clear risk-reward ratio so that you can minimise losses.

3. Improve your financial literacy:

Let's be honest, financial statements can be daunting for the beginner investor as there can be lots of data to go over. However, data is worthless to the investor who doesn't know how to decipher them. Many pitfalls and red flags can be missed if we are not able to read the balance sheet well.

Then again, some companies can have "creative accounting" or fraudulent financial statements. It would be up to the experience of the investor to detect any thing that simply does not add up.

This is a famous quote attributed to Robert Orben, who was a comedy writer. The premise of this quote is in the context of that while getting a college education is expensive, the longer term cost of not having a college education is much worse. In terms of investment, getting a "proper" financial education is key to an investor's success in today's market.

Educating ourselves is an INVESTMENT in itself. In the past, the odds were stacked against the end-consumer and retail investor. However, with the age of the Internet, there are now many ways in which we can improve our financial literacy.

Education is NOT FREE. By this, I don't mean that we should therefore sign up those 3-5 day expensive investing courses that offer to teach us "secrets to investing" (try finishing the free courses online first). If these trainers are so successful, they wouldn't spend their time sharing that secret with you. What the price to pay here is often time, and effort spent to study the subject of investing in great detail. There are often no shortcuts. Just by attending a 3-5 day course do we really think we can become experts? Get real!

Lack of Education will surely result in loss down the road. We will either pay the price studying at the early stages or make mistakes at later stages resulting from not making effort to learn. This would be in making bad financial decisions to bad investment decisions. I'm sure the latter price is bigger to pay.

Tips to improve our Financial Literacy:

1. Online Free courses to get basics:

Udemy and Coursera offer many FREE financial literacy courses online and they go from personal finance to planning and making sense of basics to finances.

13 Free Classes to Help You Manage Your Personal Finances (Like an Adult)

2. Singapore government websites:

These sites put Financial literacy in context for Singaporeans. The Singapore government also has very useful websites in helping us understand financial literacy: MoneySense , SIAS - Securities Investors Association (Singapore) and Life Insurance association Singapore (LIA)

3. Follow news/ engage in investing social media platforms:

Like Investing Note, StocksCafe, Hardwarezone (money mind). There are many "noise" in some of these posts but also nuggets of truth to be learnt when we learn from others successes/mistakes and also exchange ideas. Iron sharpens iron, and so does minds when pit together. Ask questions, ask, ask ask. A great teacher I knew often said there were no such thing as "stupid questions". People may make us look stupid for 5 minutes, but hey that's better than keeping quiet and being stupid for 50 years.

4. Search the Internet (READ WIDELY):

There are a wealth of investment bloggers who share their experience freely and usually many of them have no conflict of interest in selling you courses etc. It is your choice to believe them or not and to see if their experiences and ideas are useful for our own investing journey. Financial news websites also keep us up to date with the latest developments in the financial markets. Access to data and information is key in this new age of investing.

P.S. There seems to be something brewing about being the "Best in the World". Lets hope investors won't get burnt this time round.

1. Do Due Diligence (DYODD)

Never buy securities based on banks' recommendations alone and never buy what you do not understand (think perpetual securities). Never ask the barber if we need a haircut. If we go to banks and they recommend certain securities, we ought to be careful to research if the securities' risk to reward is worth it. We might just get more than what we bargain for if it goes south.

Never under-estimate companies with poor financials, they are simply not worth the heartpain. Take note of potential warning signs (Poor management, increasing debts/falling profit margins/lack of free cashflow). Base your investments on facts and not emotions. Don't just assume it is safe if big funds/many retailers are also investing in what you are going to invest in. This might be a false sense of security.

2. Diversify/Size our holdings:

By diversifying our holdings across different sectors, we are minimising over exposure to any one sector. It could dilute our earnings but it could also mean our portfolios can float better if certain investments go south. If we cannot find sufficient relevant information to build a case for investment about certain stocks, we should size and position accordingly if we still decide to invest so that it remains a small proportion of our portfolio as it is likely to be more risky.

Set up a trading/investment plan with strict stop losses and clear risk-reward ratio so that you can minimise losses.

3. Improve your financial literacy:

Let's be honest, financial statements can be daunting for the beginner investor as there can be lots of data to go over. However, data is worthless to the investor who doesn't know how to decipher them. Many pitfalls and red flags can be missed if we are not able to read the balance sheet well.

Then again, some companies can have "creative accounting" or fraudulent financial statements. It would be up to the experience of the investor to detect any thing that simply does not add up.

If You Think Education Is Expensive, Try Ignorance.

This is a famous quote attributed to Robert Orben, who was a comedy writer. The premise of this quote is in the context of that while getting a college education is expensive, the longer term cost of not having a college education is much worse. In terms of investment, getting a "proper" financial education is key to an investor's success in today's market.

Educating ourselves is an INVESTMENT in itself. In the past, the odds were stacked against the end-consumer and retail investor. However, with the age of the Internet, there are now many ways in which we can improve our financial literacy.

Education is NOT FREE. By this, I don't mean that we should therefore sign up those 3-5 day expensive investing courses that offer to teach us "secrets to investing" (try finishing the free courses online first). If these trainers are so successful, they wouldn't spend their time sharing that secret with you. What the price to pay here is often time, and effort spent to study the subject of investing in great detail. There are often no shortcuts. Just by attending a 3-5 day course do we really think we can become experts? Get real!

Lack of Education will surely result in loss down the road. We will either pay the price studying at the early stages or make mistakes at later stages resulting from not making effort to learn. This would be in making bad financial decisions to bad investment decisions. I'm sure the latter price is bigger to pay.

Lazy hands make for poverty, but diligent hands bring wealth. - Proverbs 10:4

Tips to improve our Financial Literacy:

1. Online Free courses to get basics:

Udemy and Coursera offer many FREE financial literacy courses online and they go from personal finance to planning and making sense of basics to finances.

13 Free Classes to Help You Manage Your Personal Finances (Like an Adult)

2. Singapore government websites:

These sites put Financial literacy in context for Singaporeans. The Singapore government also has very useful websites in helping us understand financial literacy: MoneySense , SIAS - Securities Investors Association (Singapore) and Life Insurance association Singapore (LIA)

3. Follow news/ engage in investing social media platforms:

Like Investing Note, StocksCafe, Hardwarezone (money mind). There are many "noise" in some of these posts but also nuggets of truth to be learnt when we learn from others successes/mistakes and also exchange ideas. Iron sharpens iron, and so does minds when pit together. Ask questions, ask, ask ask. A great teacher I knew often said there were no such thing as "stupid questions". People may make us look stupid for 5 minutes, but hey that's better than keeping quiet and being stupid for 50 years.

4. Search the Internet (READ WIDELY):

There are a wealth of investment bloggers who share their experience freely and usually many of them have no conflict of interest in selling you courses etc. It is your choice to believe them or not and to see if their experiences and ideas are useful for our own investing journey. Financial news websites also keep us up to date with the latest developments in the financial markets. Access to data and information is key in this new age of investing.

P.S. There seems to be something brewing about being the "Best in the World". Lets hope investors won't get burnt this time round.

Until Next Time,

K.C.

If you like this post, you might like our facebook page as well. I'm also on Investing Note.

Related topics:

1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

4. My 2018 Year end review

1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

4. My 2018 Year end review

---------------------------------------------

Disclaimer: The above information are for personal discussion purposes only and do not constitute financial advice. Do conduct your due diligence before making any financial decision. "30 Year Old Investor" shall not be liable for any loss or damage of any kind arising from the result of your reliance of the information contained on this site.