2019 has been a good year (overall) for me.

From being retrenched to getting a pay raise and new opportunities: I did get more busy with work and commitments but it would be best to capture down my thoughts while they are still fresh.

NOVEMBER UPDATE (STOCKS):

I have been purely focusing on my work which I have gotten up to speed. As a result, there were only 2 stocks that I have purchased from the period of late June up till November:

The two stocks are Japfa (SGX:UD2) and AIMS APAC Reit (SGX:O5RU). I will go straight to the point regarding the motivations behind getting these 2 counters. These 2 counters experienced some distress which caused their stock price to be "punished". The fundamentals of these 2 remained largely unchanged but was beat down due to short term reasons.

Japfa (SGX:UD2)

|

| Source: https://www.businesstimes.com.sg/companies-markets/brokers-take-cgs-cimb-downgrades-japfa-to-reduce-after-african-swine-fever |

|

| Source: Japfa website |

Japfa's dairy segment:

|

| Source: Japfa website |

Japfa's consumer food segment

Japfa also supplies processed food with their own supply of poultry, beef and aquaculture farms to mainly the Indonesia market and also Vietnam.

Japfa's animal protein segment (the troubled one):

|

| Source: Japfa website |

|

| Source: http://www.fao.org/ag/againfo/programmes/en/empres/ASF/situation_update.html |

The African Swine Fever (ASF) outbreak hit its swine business as Japfa engages in Swine feed manufacturing & distribution, GP-PS breeding, Commercial piglet production & distribution and Fattening of commercial piglets under JAPFA COMFEED VIETNAM LTD. CO. The ASF hit a host of asian countries from late 2018 and continued through most of 2019 as countries took action to control the outbreak with pig culling, legislation on illegal vaccines, movement control.

|

| Source: https://www.straitstimes.com/asia/se-asia/indonesia-says-throw-eggs-away-to-support-chicken-meat-prices |

I entered Japfa on 21 June with EP of $0.535. From March onwards it was on a downtrend and headwind from the distressed segments played out. However it has since rebounded off in October. This was probably off the news Japfa posting revenue of US$952.2 million, with an 8.5% growth compared to US$877.4 million of the same period last year (despite the troubles).

|

| Source : Japfa 3Q2019 Financial Results |

One interesting point to note was that while overall Revenue increased, the operating profitability dropped significantly. As such I would expect it to start retracing, but this run could continue for a while through to the Chinese New Year festive periods.

Japfa Summary Action:

EP: $0.535 (10,000 shares) - 21 Jun 2019

Sold: $0.555 - 8 Nov 2019

Happy to sell for a small small profit to fund one of my overseas purchase since it was a relatively short term speculative position. (Short term because I think of myself as a passive long term investor) All that work for $150 gain, I know I know. lol. I admit I was okay to just breakeven given the backdrop of having to stomach it going down to 0.4X. More astute investors/traders among my circle added more when it went down further. I did not. So therefore, I still think my emotional side is not as disciplined in execution of trade plans. Hindsight is 20/20 as they say. But I'm happy to reduce losses from last year, no matter how small the amount is.

I was able to hold down on my EP even when it dropped to lows of $0.45 because of holding power. As I did not need the money invested I could afford to hold it until it turnaround. However, I did not expect it to continue in an upward trend as it is doing now (Short term uptrend intact). I would expect it to retrace at some point later on.

AIMS APAC Reit or AAreit (SGX:O5RU)

|

| Source: https://www.businesstimes.com.sg/companies-markets/hot-stock-aa-reit-tumbles-68-after-bookbuilding-exercise |

According to a Business times article (16 Oct 19): "AIMS Financial, AA Reit’s sole sponsor, had placed out 70.3 million secondary units in the Reit at S$1.35 apiece, raising some S$94.9 million. It also represents an 8.8 per cent discount to the units' closing price of S$1.48 on Oct 15.

The placement units comprised 10.09 per cent of the total number of AA Reit units currently in issue. They were placed out to predominantly new investors, including institutional, sovereign wealth, family office and high net worth investors across the Asia-Pacific and Europe, the manager said during the midday break.

The secondary placement occurred via a bookbuilding process by Merrill Lynch (Singapore), DBS Bank and Maybank Kim Eng Securities on the same day."

New shares or old shares?

Another Business Times article said on the same day: "The placement came after AIMS exercised the call option relating to the 70.3 million units, which were previously held by AIMS' former joint venture partner AMP Capital Investors and its affiliates."

https://www.investopedia.com/terms/s/secondaryoffering.asp

According to investopedia, "There are two types of secondary offerings. A non-dilutive secondary offering is a sale of securities in which one or more major stockholders in a company sell all or a large portion of their holdings. The proceeds from this sale are paid to the stockholders that sell their shares. Meanwhile, a dilutive secondary offering involves creating new shares and offering them for public sale."

Since the 70.3 million units were previously held, they couldn't have been new units. (therefore technically, non-dilutive) but it got punished nonetheless.

Of course, if we were existing holders, this feels like a "dilution" although it is not as they sold it cheaper than valuation. But since I did not hold any shares, the "punished" stock presented a rare buying in opportunity - with the fundamentals unchanged.

AAreit Summary Action:

EP: $1.38 (3,000 shares) - 18 Oct 2019

I do think that this stock can be held down for the longer term. I wanted to buy 6,000 shares but as usual of my plan sizing, I will buy half. This is also in line with my aims to keep a certain amount of cash.

Update: AAreit also offered a DRP (reinvestment plan) to give out recent dividends at the price of $1.368. (current trading at 1.44) which I will subscribe for this time.

Stock monitoring at the moment:

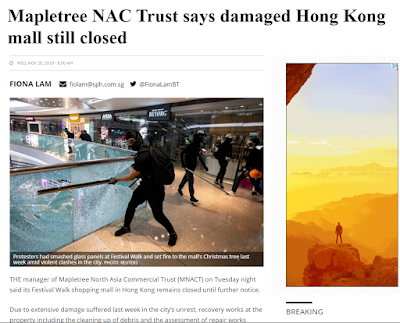

I am looking at Mapletree NAC Tr (SGX: RW0U) and HongkongLand USD (SGX: H78). This is because with the situation in Hong Kong, this stock has similarly been "punished".

|

| Source: https://www.businesstimes.com.sg/companies-markets/mapletree-nac-trust-says-damaged-hong-kong-mall-still-closed |

MNAC, for example has fallen from recent highs of 1.46-ish to current levels at 1.14. Not all "punished" stocks present good opportunities and we need to do our homework to determine if they are short term fall or long term fundamental changes. (Think lippo malls as a result of their sponsors and Indonesia government's tax law changes in the past)

Company trip 2019

This year has been overall a good year and there is really little for me to complain about. During the early portion of the year, my old company was facing headwind so there was little work to do. Eventually, when the retrenchment axe came, I was able to secure a new job opportunity that started within 2 weeks after my old employment ceased. With it came along an increase in pay and brand new opportunities to learn. Thank God it all worked out in the end.

My heart is full of thanksgiving as also because as a result of the retrenchment, I made friends with a local SME CEO (I went for interview at his company but accepted another offer) whom I could really click well, and in come sense, what he shares about his challenges and mindset really inspire and intrigue me. I'm also humbled that he does not consider beneath him to make friends with me or share his thoughts. (I'm just a poor young man from a poor background, trying to find his way in the marketplace today)

My current work comes with its own set of challenges as well. However, I think all in all, after interaction with so many colleagues, my boss and supervisor are generally very supportive in terms of work. The culture at work is also a very positive one.

The question of "doing just enough" or "beyond call of duty"

One thing that constantly comes to mind is this: How do I grow in my career and also breakthrough?

From my exchanges with my seniors and the CEO friend, there are generally 2 types of workers (doesn't mean low value workers earn less, in fact some can earn alot but are comfortable):

1. The low value worker:

- Does only what is required of him/her

- Very comfortable and not willing to do more

- Will NOT lose an arm or limb for the company

- Brings lesser value to a company as they may not be very good at their primary tasks or their job doesn't require skilled or niche labour. (anyone can do their work)

2. The high value worker:

- Will do beyond what they are required of

- Willing to partake in challenges with the company

- Will sometimes put company interests ahead of self (workaholics)

- Bring more value to the company as they are good with their primary tasks but also able to offer a wider range of experience.

It is not surprising that with the waves of digitalisation, many PMETs find themselves retrenched. This is because they may earn alot and think they know alot, but fail to pre-empt and adapt to changes in this new economy. I would like to think that we ought to want to be the high value worker rather than the low value worker.

Doing more sometimes is the way to learn new things and discover that we can actually excel beyond our comfort zones. Without displaying that we are capable of much more and being comfortable in our roles, we cannot possibly hope for advancements in our careers.

Yup, I know. Some of us are thinking, work life balance, family and etc.

But this is where I feel we lose out to foreign talent (of our own excuses and choice to become comfortable) because they are far more hungry than us Singaporeans. If we were bosses ourselves, would we hire Singaporeans?

This is the thinking point. Having gained the exposure to overseas colleagues and organisations to see how they operate or work, I just don't see how Singaporeans can hope to win against the competition unless we buck up in our own attitudes and mindset. Are we just another 打工仔, and a low value one at that? The globalised world presents the sort of competitiveness not present in our parents' baby boomers era: someone from the other side of the globe can easily replace your work today either via outsourcing or totally come to Singapore to take over us.

I see how hard my current boss at his 50s work. I see how some people have moved into better roles (with more responsibilities) because they showed that they can do more. I also see people who are very comfortable with what they have, being okay to work 8-5 and go back to their families daily.

Don't get me wrong though, I think this is down to personal opinion and there is nothing right or wrong about being comfortable. Some are perfectly fine with it. But to me there is the danger of being retrenched later on because we don't see the danger until it is too late. (Having been through one is painful enough, even at age 30)

Moreover, if we think we should be paid more, are we delivering more value than what we are being paid for?

Summary thoughts

I will want to work harder now that I am still

As my young (early 40s) global division manager said, always be open and try things, even when we think we may not like them or think we couldn't do them - because we can simply be wrong about it and could end up liking it. He himself was asked to do something he didn't like but he excelled in it and the interest grew over time.

Keep an open and learning mind. Yes, that's what I would do. Be proactive. Do beyond what we are told to. Be hungry. Do what people tell you that you cannot do.

p.s. I also watched a documentary on LV on my flight back which is very interesting as well. Which I will blog in another post on why I think we should try to move towards business side as an employee (below is a breakdown of LV's cost and margin)

Until Next Time,

K.C.

If you like this post, you might like our facebook page as well. I'm also on Investing Note.

Related topics:

1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

4. Interview process cycle: How to increase your interview rates

5. My 2018 Year end review

6. I'm retrenched: 3 things to think about

7. Why I refuse to spend >15-30 minutes budgeting each month1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

4. Interview process cycle: How to increase your interview rates

5. My 2018 Year end review

6. I'm retrenched: 3 things to think about

Disclaimer: The views expressed, opinion and information in this article are strictly for informational purposes to encourage educational discussions only. It is important to conduct your own analysis before making any investment decisions based on your own personal circumstances. You should take reasonable measures such as seeking independent financial advice from professionals and/or independently research and verify the information that you find on "30 Year Old Investor" before undertaking any important investment decisions. No content on this site constitutes - or should be understood as constituting - a recommendation to enter any securities transactions or to engage in any of the investment strategies presented in our site content. We do not provide personalised recommendations or views as to whether a particular stock or investment approach is suitable to the financial needs of a specific individual. No representation or warranty expressed or implied is made as to, and no reliance shall be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained on this website. "30 Year Old Investor" shall not be liable whatsoever for loss or damages of any kind arising from the result of any use, reliance or distribution of the articles or its contents from information contained on this website.