Recent developments in this REIT is going to see a few changes going forward (A meeting will be held on 8 May to decide if the following goes through):

1. Proposed acquisition of 21 properties in Germany and Netherlands

2. Proposed issue of 525,000,000 new units under equity funds raising

3. Proposed issue and placement of new units to FPL & TCC group investments (private placement)

For the full circular, please read it in its entirety: https://flt.frasersproperty.com/newsroom/20180423_075002_BUOU_NA4AUENJ0NRZLRGW.3.pdf

So who are the sponsors and what are they doing with FLT?

The sponsor of FLT is Frasers Property Limited (formerly known as Frasers Centrepoint Limited) (“FPL” or the “Sponsor”), a multi-national company that owns, develops and manages a diverse, integrated portfolio of properties. Listed on the Main Board of the SGX-ST and headquartered in Singapore, FPL is organised around five asset classes with assets totalling S$28 billion as at 31 December 2017. FPL’s assets range from residential, retail, commercial and business parks, to industrial and logistics in Singapore, Australia, Europe, China and Southeast Asia. Its well-established hospitality business owns and/or operates serviced apartments and hotels in over 80 cities across Asia, Australia, Europe, the Middle East and Africa. FPL is unified by its commitment to deliver enriching and memorable experiences for customers and stakeholders, leveraging knowledge and capabilities from across markets and property sectors, to deliver value in its multiple asset classes."

|

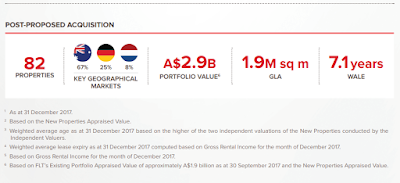

| FLT's latest circular to unit holders The 61 Australia assets in FLT are now set to include 21 new properties in Germany and Netherlands. This will also mean its estimated portfolio value is expected to increase from A$1.9billion to A$2.9billion. By no means is this a small amount of money so accordingly we are seeing FPL raising it though a combination of equity fund raising and private placement of units. The one good outcome of this acquisition is that FLT's concentration risk will now be diversified into approximately 67% Australia, 25% Germany and 8% Netherlands.

Germany and Netherlands present a good market for trade oriented economy and the resulting acquisition will also be made up of a more diversified mix of tenants. Likewise, the concentration risk due to geographical location is also diluted. The assets are also up to 71% freehold.

The sponsors have also negotiated a ROFR on many of the assets:

Right of first refusal (ROFR or RFR) is a contractual right that gives its holder the option to enter a business transaction with the owner of something, according to specified terms, before the owner is entitled to enter into that transaction with a third party. Lastly, the REIT is expected to be DPU accretive.

These changes are subjected to approval from unitholders who should most likely approve of the acquisition as there doesn't seem to be a bad thing where this REIT is headed. If it goes through, the acquisition could be done by late July 2018. Gearing, however will be increased from 29.3% to 35.4%.

Appendix C of the circular also includes an interesting independent market research done on the following if you are interested: "INDUSTRIAL AND LOGISTICS MARKET OVERVIEW: GERMANY AND THE NETHERLANDS"

Vested at $1.06 on 25th April 2018.

Until Next Time, K.C.

If you like this post, you might like our facebook page as well.

|

No comments:

Post a Comment