Money. Finances. Always an important topic that is relevant in all ages. Yet, if there is anything our education system has failed to teach us about, it is about personal finances and handling money. In the past, information was not always readily available to the average person. Rich(er) people usually have the money, contacts and knowledge to their advantage.

Edit: One reader who is a teacher said now that they have started to teach financial literacy in schools at primary two. A good start perhaps. Better late than never.

Today, the internet boom has leveled the playing field quite a bit in terms of knowledge dissemination. If we search the internet well enough, there are a ton of information readily available.

But, the enemy is usually always ourselves.

I'm also lazy.

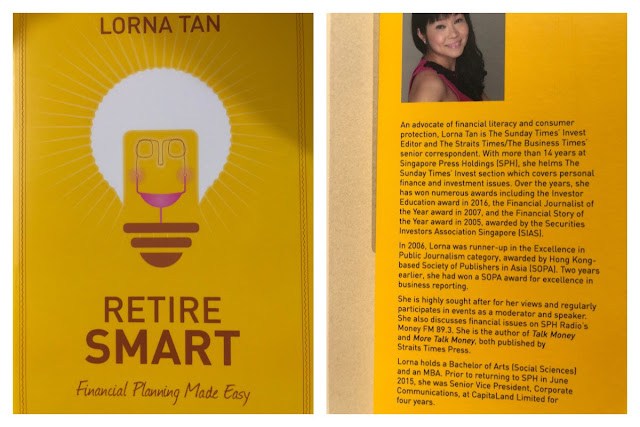

Too bad I went the long way before someone like Lorna Tan (Invest Times editor) collated the book above. There are many books on finances worldwide but hardly many for the Singaporean context. Most of the content in the book are not biased but factual and has some case studies and scenarios which are applicable to many of us.

A quick glance at the contents would find the following important concepts that are brief, but detailed enough to enlighten the average Singaporean on the following:

- CPF

- Legacy planning (what happens to our wealth when we pass away)

- Planning finances for yourself and loved ones

- Credit Card and debts

- Insurance

- Investment tools common in SG market (ETFs, REITs, bonds, Singapore savings bonds)

Too bad, I already know much of these stuff but I took about 5 years to know them, and through some obstacles. Anyway, I bought one copy and figured that someone I know around me can borrow this from me and benefit from it.

If you are lazy like me but still care about your money, you will probably like this book.

Until Next Time,

K.C.

If you like this post, you might like our facebook page as well.

Related topics:

1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

If you are lazy like me but still care about your money, you will probably like this book.

Until Next Time,

K.C.

If you like this post, you might like our facebook page as well.

Related topics:

1. About K.C. What is my story?

2. My 3Cs to money/investing

3. Why you need to set aside money for savings first

No comments:

Post a Comment